Contents:

Then wait for the price to close back above 38.2% as your entry trigger. I think that the information is necessary for you to use Fibonacci trading tools with confidence. Now, it’s similar to the Fibonacci extension tool as well. This post is written by Jet Toyco, a trader and trading coach.

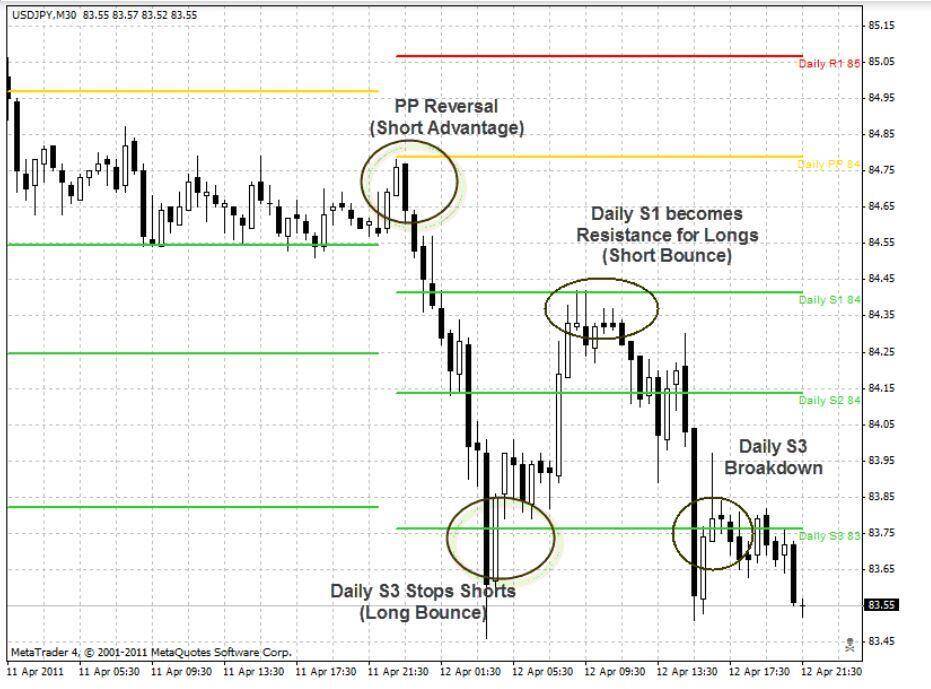

It turns out that these ratios along with 50% represent the support and resistance levels in price movements, so they’re used to identify the Fibonacci retracement levels. Fibonacci retracement level channels are resistance and support levels built on extremes, but not linked to the horizontal position. If the grid of correction levels is stretched only in the vertical and horizontal planes, the trader is the one who determines the angle of the support and resistance. Fibonacci projections are used by traders in forex, stocks, commodities, and other financial markets to make informed investment decisions. The key levels identified by the Fibonacci projection tool can help traders determine potential entry and exit points, as well as set stop-loss orders. Fibonacci retracement indicator does a decent job in accurately identifying key reversal points.

Ichimoku Cloud Indicator in Forex: What are Ichimoku Strategy Best Settings

Fibonacci retracement levels can be used to identify your entry points , to set your exit points , or to decide where to put your stop-loss order. The usual method for limiting losses with a stop order is placing the stop order slightly below a Fibonacci level. There are lots of tools used in technical analysis to help predict the future of market trends. Among them are Fibonacci retracements and extensions, which are tools based on a string of numbers called the Fibonacci sequence. Overall, the Fibonacci trading strategy can be a useful tool for traders looking to improve their analysis and make more informed trading decisions.

Tata Motors, M&M, Maruti Suzuki: How should you trade these auto stocks? – Business Today

Tata Motors, M&M, Maruti Suzuki: How should you trade these auto stocks?.

Posted: Thu, 13 Apr 2023 02:49:22 GMT [source]

Once price moves below a swing low and begins to retrace a new swing low has formed. A swing high forms when price reaches a new high relative to any preceding highs. Once price moves above a swing high and begins to retrace a new swing high has formed. The ratio was founded by mathematician Leonardo Pisano, nicknamed Fibonacci.

Step #1 Find a Strong Down Trend/ Uptrend that is Forming

I only focus on 50% retracements but should you decide to use fibonacci your trading make sure to try out more of the key levels discussed earlier. Consequently, integrating the Fibonacci retracement trading rules depicted in this article into your technical analysis toolset will allow you to have better insight into market swings. In the example above, you can see how the Fibonacci sequence Bitcoin chart, where it allows you to take profits from price swings. Breakouts provide buy signals, where the target is the next Fibonacci retracement level. On the other hand, breaking down from Fibonacci sequence levels provides either short entries, or allows you to place stop losses in case of a fakeout. As mentioned earlier, when trading downtrend or uptrend Fibonacci retracement, the levels will provide you with crucial support and resistance levels.

GBP/USD Forex Signal: More Upside But Rally Could Take a Breather – DailyForex.com

GBP/USD Forex Signal: More Upside But Rally Could Take a Breather.

Posted: Mon, 17 Apr 2023 07:15:17 GMT [source]

The equation shows that the 50% Fibonacci level for the price increase from $20 to $30 is $25. This means that the price should retrace at $25 while trending upwards from $20 to $30. Similarly, you can also calculate the 50% Fibonacci level, though it isn’t “technically” considered part of the sequence. In this number sequence, each number is the sum of the two numbers immediately preceding it. As the sequence continues, they form a pattern where each number is approximately 1.618 times greater than the preceding one.

How do you draw a Fibonacci retracement?

That said, crypto Fibonacci retracements on longer timeframes will present stronger trend indicators than those on shorter timeframes. The main advantage of Fibonacci levels is their versatility. These tools are based on more than a hundred-year-old theory that has been actively used in the stock market and Forex market analysis for decades. Recently, it has been adopted in the cryptocurrency trading as well. The tool’s versatility allows it to be relevant regardless of the market changes, whether it is more volatile or calm. Fibonacci levels are used both as a standalone indicator and as a part of strategies based on other indicators.

Furthermore, you should make sure that the market is indeed trending. This can be done by using trend-following indicators such as the moving averages. One of the most popular ways to use Fibonacci Retracement is to identify potential support and resistance levels. As you may know, support and resistance levels are price levels where the market has a tendency to reverse direction.

The most commonly used Fibonacci retracement levels are 38.2%, 50%, and 61.8%. The Fibonacci retracement level gives technical traders a good edge in the market. The Fibonacci retracement tool is one of the most common trading too on charting software (MT4/MT5). Support and resistance levels on a price chart are one of the most common auxiliary technical analysis tools.

Had I only been focused on my shorter scalping time frames, I would never had known that the trade had the potential for that big of a move. Now that doesn’t mean I will go blindly long or short at these levels. It means that if I see a setup from my playbook at one of these levels I’m going take it and be cognizant that it could be a big reversal and become more aggressive on my take profit. Now your tool will plot the fib extensions on your chart that begin from the retracement low as seen above. Finally, you can consider taking your profits at the Fibonacci retracement 88.6% level. Then enter the trade when the price closes back above the area of support.

The Essential Guide To Fibonacci Trading

Fibonacci extensions are a method of technical analysis commonly used to aid in placing profit targets. The Fibonacci retracement levels are all derived from this number string. After the sequence gets going, dividing one number by the next number yields 0.618, or 61.8%. Divide a number by the second number to its right, and the result is 0.382 or 38.2%. All the ratios, except for 50% , are based on some mathematical calculation involving this number string.

For example, https://traderoom.info/ may move just slightly above the 161.8% level before reversing, or it could stop just shy of that level and reverse. Fibonacci trading is based on a key series of numbers discovered in the 13th century by Italian mathematician Leonardo Fibonacci. The series of numbers is created by adding each of the next two numbers in the series to create the following number. Thus the series goes 0, 1, 1, 2, 3, 5, 8, 13, 21, etc, into infinity. In technical analysis of financial markets the numbers themselves aren’t as important as the ratios between the numbers.

The Fibonacci levels can give you a good idea of where the support and resistance levels are in an asset’s price. They can also help you to identify potential entry and exit points. For example, if you see that the asset’s price is retracing to a Fibonacci level, you might enter a trade at that point in the hope that the price will rebound off of that level. As Fibonacci levels are essentially classic support/resistance levels, it is not difficult to combine them with other technical analysis tools.

Information is of a general nature only and does not consider your financial objectives, needs or personal circumstances. Important legal documents in relation to our products and services are available on our website. You should read and understand these documents before applying for any AxiTrader products or services and obtain independent professional advice as necessary. BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following.

Fibonacci Support and Resistance Levels

Just after price broke the upward sloping trendline and previous market structure, a low formed, and a correction followed. This was an indication that the previous uptrend changed to a downtrend and that the strategy requires a trader to look for selling opportunities after a counter-trend reversal. Fibonacci extensions are typically used to determine where a trending market might find support or resistance. Traders often use these extension ratios to judge where they should place their targets or take partial profit.

The Fibonacci tool is ideal to identify swing-points during pullbacks as the sequence indicates. With the Fibonacci retracement tool, a trader would have been able to find 2 Fibonacci re-entries on the pullbacks. I use fib retarcements to define key support and resistance levels every morning pre-market.

Ethereum 2023 Prediction – Is $3000 Possible? – CryptoTicker.io – Bitcoin Price, Ethereum Price & Crypto News

Ethereum 2023 Prediction – Is $3000 Possible?.

Posted: Fri, 31 Mar 2023 07:00:00 GMT [source]

To get the most out of this guide, fibonacci stop loss recommended to practice putting these Fibonacci retracements into action. The best risk-free way to test these strategies is with a demo account, which gives you access to our trading platform and $50,000 in virtual funds for you to practice with. That being said, many traders use Fibonacci retracement in combination with other indicators and technical signals, demonstrating its effectiveness when used correctly. Converted into decimal values, the Fibonacci retracement levels are 0, 0.236, 0.382, 0.5, 0.618, 0.786 and 1. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.39% of retail investor accounts lose money when trading CFDs with this provider.

Parabolic SAR Indicator: Formula, Best Settings & Strategies

Apply the grid only to trending strategies and only as an additional confirmation tool. Wait for the beginning of the trend reversal or its exit from the flat. Wait for the beginning of a new trend – a change in direction after a fading movement or exiting a flat. For an uptrend, the grid is built from the low of the reference candle; for a downtrend – from the high. It is important to note that any type of trading comes with high risk. Thus, to avoid losing your initial investment constantly educate yourself, seek independent financial advice, and remember the risks involved.

- This will help you minimise losses in a rising market and maximise profits in a falling market.

- The reference point is the starting point from which the Fibonacci levels are drawn and it’s important to use the same reference point for all of the levels.

- He developed a simple series of numbers that created Fibonacci ratios describing the natural proportions of things in the universe.

- By using indicators like Fibonnaci extensions and retracement…

These levels are widely used in forex, stocks, and cryptocurrency trading to make informed trading decisions and increase the chances of success. The Fibonacci sequence is relevant to financial markets because it is used to identify potential levels of support and resistance for a financial asset’s price. The sequence is derived from adding the previous two numbers to get the next number, starting from 0 and 1. In technical analysis, traders and investors use Fibonacci retracements to identify levels at which an asset’s price may experience support or resistance after a price move.

In both cases, in the H1 chart, the grid was built in a section no longer than 3 weeks. On a downtrend, the starting point will be the first high of its beginning. In an upward movement, the starting point will be the first low of the trend start. If you analyze the already completed trend in order to find the next correction zones, focus on the lowest and highest points. Stretch the formulas across all levels, and the contents expand table accordingly.

Trading in CFDs carry a high level of risk thus may not be appropriate for all investors. With Fibonacci numbers, once a pattern completes against a Fibonacci price area, traders can use them to lock in profits. This indication of how far a profit may run enables traders to lock in profits at predefined levels. When you apply the Fibonacci retracement tool to your price chart, you get a price chart with many lines that depict different price levels. The strategy not only highlights entry and exit points, but it also reduces your risk by indicating a low-risk stop-loss point as well. You can enter the market at 23.6% Fibonacci level or $27.64 price level while keeping a stop-loss just below this level, perhaps at $27.00.

Open a position after the price passes the 50% or 61.8% level in the direction of the reversal. Any strategy involves combining different technical analysis approaches. In this case, the candle indicated by the blue arrow is aclassic pin-bar pattern, a reversal candle formation confirming a potential reversal. The grid stretched based on the third high shows how Fibonacci levels can be used as resistance and support levels that define the boundaries of local price channels. The Fibonacci retracement levels show the approximate levels of the end of the Elliott trend waves. The instrument is not perfect and theory can be very different from practice.

- Tirone levels are a series of three sequentially higher horizontal lines used to identify possible areas of support and resistance for the price of an asset.

- Fibonacci retracements are trend lines drawn between two significant points, usually between absolute lows and absolute highs, plotted on a chart.

- Monitor the correction and open trades at the moment of its completion at key correction levels.

We open the second trade at the moment of a rebound from the level of 0.382, and set take profit at around 0.236. After the second endpoint is locked, you can drag it horizontally to the right. This makes it more convenient to analyze the subsequent price movement within the colored zones of the indicator. Two parallel lines showing the boundaries of the channel with additional parallel lines inside it. The distance between the lines is calculated using the Fibonacci tool ratio. From his work, we get the Fibonacci sequence of numbers and the well-known Fibonacci golden ratio.