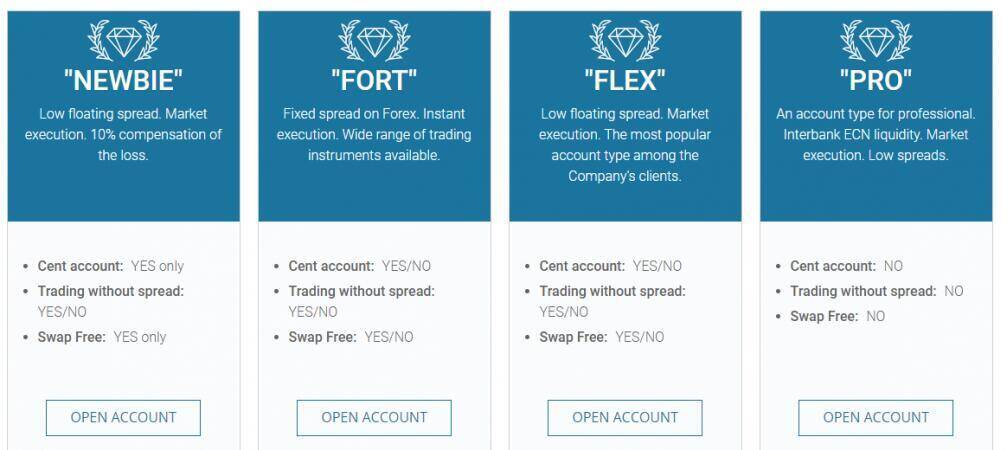

Con nuestro servicio de mantenimiento cuidamos de tu hogar y de tu bolsillo. Contrata el servicio FACILITA y aumenta tus descuentos en energías luz y/o gas. Las dos compañías TotalEnergies y Naturgy proponen ofertas 100% online y ofertas con servicio al cliente Para el primer tipo de ofertas, no es posible comunicarse con un asesor telefónicamente, pues toda gestión debe hacerse por e-mail, chat o redes sociales. Para el segundo tipo de ofertas, las dos compañías TotalEnergies y Naturgy tienen disponible para sus clientes un servicio al cliente de calidad para dar respuesta a todas las solicitudes.

- Si estás buscando una comercializadora de luz y gas que te ofrezca las mejores condiciones para tu hogar, seguramente te habrás encontrado con muchas opciones en el mercado.

- Porque no todas las energéticas son iguales, trabajamos para darte la mejor energía 100% renovable, una gran atención al cliente y precios claros, sin sorpresas.

- Por ello ponemos a nuestros expertos a disposición de nuestros clientes para valorar todos estos parámetros e identificar la mejor oferta de energía para tu empresa.

- Esto significa que siempre pagarás lo mismo por tu factura de la luz, sin sorpresas ni variaciones.

- TotalEnergies pertenece a las comercializadoras más importantes del mercado eléctrico y de gas.

- Queremos cambiar y mejorar nuestro entorno, impulsando la transformación energética para mejorar la calidad de vida de las personas y sus comunidades.

Estos puntos podrán adquirirse a través de la contratación de servicios de TotalEnergies, el consumo de energía o la antigüedad en los contratos asociados a esta compañía. En la siguiente tabla se comparan las tarifas de luz de precio estable de Naturgy y A Tu Aire Siempre de TotalEnergies. El ejemplo se ha realizado en base a una vivienda con una potencia contratada de 4 kW y un consumo de 270 kWh/mes. Conoce nuestro programa de puntos y conoce todas las ventajas que tiene ser cliente TotalEnergies.

TotalEnergies: 4ª compañía de luz y gas residencial en España

Es importante tener en cuenta que el CUPS es un dato fundamental para cualquier gestión relacionada con el suministro de energía, como cambios de compañía o modificaciones en las condiciones del contrato. Ofrecerte las mejores ofertas de luz para tu hogar y que ahorres en tu factura de la luz. Nuestras https://es.forexeconomic.net/te-encantan-los-superheroes-netsuite-eleva-el-nivel-con-la-nueva-serie-de-superheroes-origins-of-captain-finance/ tarifas de luz permiten a los usuarios elegir la opción que mejor se ajuste a su estilo de vida y patrones de consumo de electricidad. Ofrecemos servicios de comercialización de gas y electricidad a clientes residenciales y pequeños negocios españoles, a través de un servicio local, cercano y fiable.

- La tarifa Tempo Happy Luz de Total Energy es una de las más populares debido a que ofrece descuentos en el precio de la luz durante las horas más baratas del día.

- One Gas, que tiene un precio fijo de 0,0499 €/kWh para el consumo de gas natural, podrás beneficiarte de un descuento del 15% sobre el término fijo de gas durante el primer año.

- TotalEnergies es un actor clave presente en toda la cadena de energía, comprometido con el suministro de energía asequible a una población en crecimiento, abordando el cambio climático y satisfaciendo las nuevas expectativas de los clientes.

- Una de ellas ha sido la de reducir el impuesto de la electricidad del 5,1127% hasta el 0,5% durante los próximos meses.

- Si lo tuyo es pagar menos, pásate a TotalEnergies y te bajamos el precio de tu factura en los planes a Tu Aire luz.

TotalEnergies pertenece a las comercializadoras más importantes del mercado eléctrico y de gas. Ofrece tarifas atractivas de energia 100% renovable y ofertas de mantenimiento. Una tarifa de luz con precio de coste es una tarifa en la que el cliente paga el precio que cuesta la energía en el mercado mayorista más una pequeña cuota de gestión. Este código está compuesto por 20 dígitos y letras y se utiliza tanto para el suministro de gas como de luz en España.

Marketing y Servicios

Además, nunca cambia; es decir, es invariable y siempre es el mismo, aunque cambies de compañía comercializadora o de tarifa. Junto a las tarifas de energía es posible contratar los servicios de mantenimiento de luz y/o gas de TotalEnergies. De esta manera, los clientes mantendrán sus instalaciones en condiciones óptimas y contarán con servicios de reparación en caso de avería. Las tarifas con discriminación horaria se dirigen a los usuarios que pueden concentrar su consumo eléctrico en las horas de menor precio o en las horas llano. Si comparamos las tarifas del gas así como el contrato de electricidad, la comercializadora TotalEnergies es significativamente más cara que la tarifa Por Uso RL.2 comercializada por Naturgy. Por ejemplo, con el contrato A tu Aire Gas RL.2 de TotalEnergies, el total a pagar ronda los 634 € en comparación con 614 € de la oferta Por Uso RL.2 de Naturgy teniendo de base un hogar con las mismas particularidades.

Aspectos positivos y negativos de TotalEnergies y Naturgy

El único requisito para canjear los puntos será estar al corriente de pago en todas las facturas de TotalEnergies. Esta adquisición también está en consonancia con el propósito de TotalEnergies de lograr la neutralidad del carbono para 2050 en todas sus actividades mundiales, desde la producción hasta el cliente final, y ser uno de los principales protagonistas de la transición energética en Europa. El Gobierno establece un precio aproximado por el alquiler de contadores digitales y ese valor viene marcado por un precio mínimo de 0,81€/mes y un precio máximo de 1,36€/mes. TotalEnergies y Naturgy son dos compañías de energía reconocidas por los consumidores, sin embargo, ¿cómo escoger la más competitiva? Hacer la elección correcta no es tan sencillo, así que para simplificarte la vida hemos puesto a tu disposición una comparación de las diferentes características de TotalEnergies y Naturgy. El motivo es que se debe finalizar el proceso de facturación, aunque este periodo de tiempo varía de una compañía a otra.

de electricidad y de gas

Ahora, TotalEnergies sustituye a EDP Residencial como fuerza importante en el sector de la luz y el gas en España. Más allá de la venta de tarifas y servicios de mantenimiento, su principal hoja de ruta consiste en modificar conciencias y potenciar el uso de las energía renovables en domicilios. Para ello, quiere promover el autoconsumo y la instalación de puntos de recarga de coches eléctricos particulares. Es importante tener en cuenta que el CUPS es un código único para cada punto de suministro y no varía aunque cambies de compañía eléctrica.

Las tarifas de precio estable son aquellas que ofrecen un único precio del kWh, sin importar las horas en las que se hace uso de la energía. Esta tarifa es la más conveniente para aquellas personas que no deseen preocuparse del horario en el que realizan su consumo. El servicio de atención al cliente de TotalEnergies ofrece un servicio gratuito de atención disponible todos los días https://es.forexgenerator.net/las-interrupciones-del-mercado-son-un-ambito-en-el-que-reino-unido-y-la-ue-podrian-colaborar-en-medio-de-divergencias-dice-cboe/ del año. TotalEnergies Electricidad y Gas es el nuevo nombre que recibe la antigua comercializadora de luz y gas EDP Residencial by Total. Lo puedes localizar y encontrar fácilmente en tus facturas energéticas, tanto de luz como de gas, puesto que siempre debe de aparecer indicado en ambos casos. En concreto, tiene que mostrarse en el apartado referente a los Datos del contrato.

Tarifa Tempo Happy Luz

Estos precios son muy competitivos si los comparamos con los de otras comercializadoras, como Endesa, Iberdrola, Naturgy o Repsol. Por ejemplo, la tarifa One Luz Nocturna de Endesa tiene un precio de 0,1582 €/kWh en horario punta y de 0,0794 €/kWh en horario valle, lo que supone una diferencia de casi 0,04 €/kWh con la tarifa de TotalEnergies, y no incluye ningún descuento ni promoción. Hacemos una comparativa real entre Naturgy y TotalEnergies (antigua EDP Residencial), para que puedas comprobar qué compañía es más económica. Te enseñamos también los precios de sus servicios de mantenimiento y las prestaciones que incluye cada uno de ellos. TotalEnergies ofrece contratos de gas verde, así como contratos de electricidad de origen fósil.

Si no tienes una factura a mano y necesitas saber el CUPS de una vivienda, puedes obtener esta información llamando a tu distribuidora eléctrica. Además, es posible que te soliciten algún dato adicional, como el número de contrato o el número de contador.Una vez que proporciones toda la información requerida, el operador de la distribuidora te facilitará el CUPS de tu vivienda. Además, puedes encontrar el CUPS en antiguas facturas o contratos de suministro eléctrico, por lo que es recomendable conservar esta documentación en un lugar seguro. Con matriz francesa y una amplia experiencia en el trading de energía en mercados internacionales para la comercialización de electricidad y gas en diferentes fases nuestro objetivo es posicionarnos entre las primeras comercializadoras eléctricas del mercado español. Por ello ponemos a nuestros expertos a disposición de nuestros clientes para valorar todos estos parámetros e identificar la mejor oferta de energía para tu empresa.

En TotalEnergies subiendo tu factura al formulario de contratación te mejoramos el precio, pero la tarifa que escojas y que te hará ahorrar verdaderamente es la que se adapte a tu estilo de vida. Además, despreocúpate de las subidas con una tarifa de luz con precio anual. Después de adquirir la compañía EDP Luz y Gas y su comercializadora del grupo en el mercado regulado, Baser Cor, TotalEnergies se ha consilidado https://es.forexdata.info/discurso-de-philip-lowe-jefe-de-rba-24-09-2019/ como el cuarto proveedor de gas y electricidad del mercado residencial español. La compañía de EDP Residencial pasa a ser TotalEnergies, también conocida como Total Gas y Electricidad España. Este cambio no afecta a los ya clientes de la comercializadora, ya que seguirán mantenimiendo las mismas condiciones y precios. Se trata de un impuesto especial que posee un tipo impositivo que está determinado por ley.